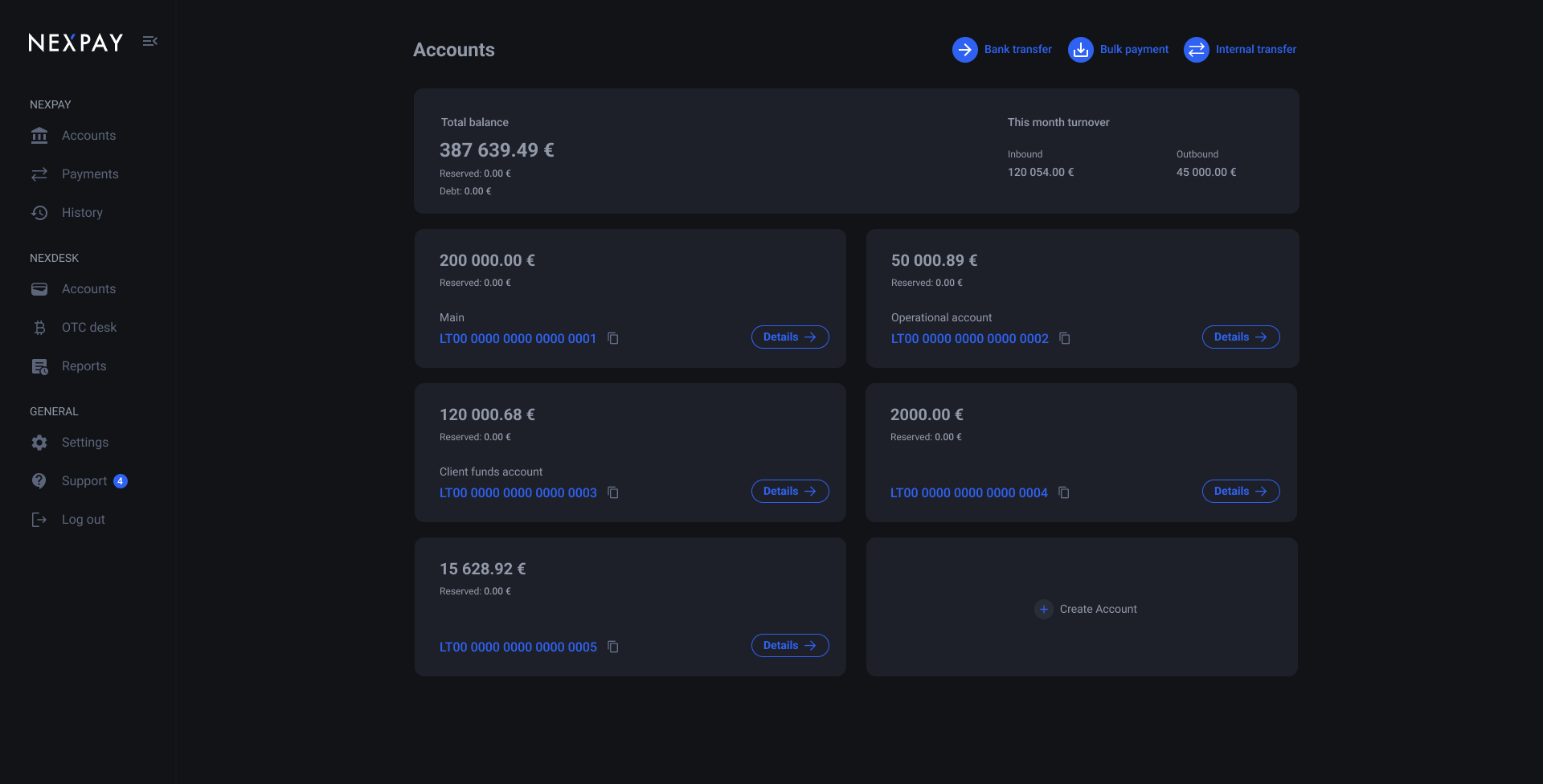

A banking partner that puts your business first

The only business payment account you need

Our pricing packages

Tailored plans for every business size

Our Membership

Meet Us There

ICE Barcelona

19-21 January, Barcelona

gaming

Pay360

25-26 March, London

paymentsfintech

UN:BLOCK

1-2 April, Riga

blockchaincrypto

Token 2049

29-30 April, Dubai

blockchaincrypto

Baltic Fintech Days

12-13 May, Riga

paymentsfintech

iFX Expo

16-18 June, Limassol

trading

iGB L!VE 25

1-2 July, London

gamingaffiliates

Baltic Honeybadger

9-10 August, Riga

crypto

SiGMA Europe

2-5 November, Rome

gamingmarketing