Taking a look back at 2020: The best worst year

2020 was one of the strangest years of my life and I imagine the same to be true for most others. A considerable transformation in the way we spend our time both privately and for work. This transformation led to a leap in technology adoption of at least five or even ten years ahead.

Forced to confinement in our homes we started consuming digital products and receiving digital services like never before, which resulted in value skyrocketing for companies like Netflix and Zoom, among general usage increase for digital services across the board. While this was happening online, the world economies were reeling offline and governments scrambled to issue substantial stimulus to battle the negative effects of lockdowns funded by newly printed money. This disillusioned a significant amount of global investors who were forced to revisit the store of value narrative of Bitcoin, the price of which was consistently growing throughout the year with a rapid escalation at year end to double previous all time high. As we are deeply entrenched in the industry, we saw our clients\' businesses expand rapidly and due to the nature of our services we got very busy with managing our own business growth.

Among other milestones, we reached 1.5 billion EUR in payments volume for our Nexpay EMI business, which is 22x more volume than we had in 2019. Serving more than 300 businesses already, we have put our name on the map as a recognized industry player. This puts us in a very strong position to consolidate our business in 2021. Over the course of the year, we doubled our team and grew our revenue more than 10X, confirming that our chosen strategy of focusing on business clients and the payments business was the right decision back in summer 2019. Globitex exchange volume increased more than 3X compared to 2019, while still lagging behind Nexpay payments business. Overall the year was highly successful and extremely busy for our team and also our clients. As we continue to build towards our mission of building the banking infrastructure for the fintechs of the future, it’s great to take a step back and look at what we have achieved so far as well as touch upon what the future holds for Globitex.

Reflecting On Key Decisions

Globitex started out as a bitcoin-fiat exchange with the ambition to be the first institutional-grade regulated crypto exchange. While we were building the platform and infrastructure to match that ambition, there were substantial changes to the competitive, regulatory and industry development landscape, which posed a significant challenge to that initial vision. While regulation was lacking and the only options were to pursue traditional financial licenses, a group of incumbents in the crypto-fiat business established domination, including the likes of Coinbase, Kraken and Bitstamp. Additionally, a new type of business model emerged, the crypto-crypto exchange with hundreds of tokens and initial coin offerings, with major success stories like Binance setting the tone in trading. To set ourselves apart, we focused on determining an updated vision, however we were still convinced about the value of securing a license, which we did at the end of 2017 by establishing a subsidiary in Lithuania Nexpay UAB that received an E-money Institution license from the Bank of Lithuania. This allowed us to “become our own bank”, which is a critical asset to the sustainability of our business as the industry has struggled with banking since its onset and to large extent continues struggling. On top of that we had developed a new vision of scaling the Bitcoin economy and linking digital currencies to global trade and financial markets by building a Spot and Derivatives exchange for standardized instruments in money markets and commodities where trading would be denominated in Bitcoin.

On the back of this vision, we managed to run a successful initial coin offering and raised funds to start executing on that vision. The ICO happened in February 2018, which was a few moments before the ICO & general crypto bubble burst launching the almost two year long crypto winter, making the following months a very stressful time for all crypto treasury managers. With crypto winter putting a big strain on the financials and the overall industry growth outlook, we were motivated to find ways to start generating revenue as fast as possible.

The assets at our disposal were:

1) a spot BTC/EUR exchange with a handful of users from the testing phase and strong and exponentially growing number of competitors;

2) An ambitious ICO business plan with institutional focus and substantial infrastructure investments necessary and a largely retail community;

3) an EMI license that allowed us to issue our own IBAN accounts, custody client funds at the Bank of Lithuania and essentially be our own bank and by extension, a payments provider for other similar businesses which were in dire need of a reliable and progressive banking partner.

We saw clearly that the third option would be the fastest way to cash flow, survival during the crypto winter and sustainable foundation to the growth of the business in the future. It was an extremely tough decision to make as we had the whole ICO community expecting us to follow the planned course of commodities exchange, however we saw clearly that sticking to that course will drive the company into a ditch within a year. Based on this conclusion, the team focused all its resources and energy to delivering a quality payments service for the crypto industry and a few months after its launch, we took a decision to focus entirely on business clients for whom the banking challenges were a lot bigger and also our product more fitting. Our value proposition to prospective clients switched from an exchange with an IBAN account attached to a payments service with a value added functionality of exchange. One of the main keys to success for startups is focus, and we proved to ourselves that this is very true by refining this strategy to achieve great growth results in 2020 and bring stability to our financials.

If Bitcoin Is Gold 2.0, Who Needs Gold

Before looking into the future, I’d like to take a moment to look at our exchange development plans with the benefit of hindsight. As mentioned before, circumstance commanded us to pivot to a more immediately lucrative business model in the payments business and keep the exchange as a spot EUR to BTC exchange primarily, however I strongly believe that if we had stayed the course of developing a spot and derivatives exchange of money market instruments and commodities in a regulated fashion, we would have run out of money before the end of 2019. The ICO was intended to fund the first phase of the roadmap, which included a spot crypto-fiat exchange, margin trading and chiefly trading of spot gold. The spot crypto exchange landscape of 2018-2019 I described in the previous paragraph, but the simple truth is this – it is close to impossible to grow a new exchange in a market that is contracting and 2018 and most of 2019 the crypto market was in a deep winter. And while there is always a demand for a fiat-crypto gateway, most of the action in those years happened in crypto-crypto exchanges, whose business model was not compatible with our licensed part of the business.

Margin trading was also thriving only on the unregulated exchanges with opaque jurisdictions with leverage up to 99x on some of them. But I believe the biggest attractor of interest to our plans was the idea of commodities trading against Bitcoin and the initial stage of spot trading of gold. While there has constantly existed a demand for gold, especially during 2020, there is an ongoing narrative battle in the crypto industry between gold and Bitcoin. There has been a long list of projects doing gold-backed tokens, none of which have become successful. The most successful has been PAX Gold with a market cap of around 120mEUR (with a sharp rise in the beginning of 2021) and daily volume at 1-2mEUR over most of 2020. The biggest gold/crypto exchange Vaultoro claims to have processed a mere 153mUSD+ traded in its whole lifetime, showing that there simply is not enough demand in the crypto industry for gold as Bitcoin beats gold for most investors operating in this space. There have also been multiple projects with other precious metals and other commodities, none of which have gained serious traction. This might change as the markets develop, however so far there hasn’t been enough of activity to build a sustainable business around.

The further development stages were fundamentally dependent on a few key factors – the first stage must have gained significant commercial traction (which was not likely due to previously described reasons) to support raising further investments; there would be required a demand for regulated trading of crypto derivatives (which so far has been marginal and most demand has been on unregulated wild west kind of platforms; there would need to be demand for using Bitcoin in global trade (which so far has not materialized at all and which we don’t foresee to come into play for several more years at least). With the benefit of hindsight, we can be happy that we didn’t follow down the initial ICO path as the likelihood of Globitex not existing anymore, would be quite high.

Nexpay First

We have operated under the Globitex brand since the beginning while keeping our payments company Nexpay UAB essentially brandless by keeping it as a product under the Globitex brand – EURO Wallet, Powered by Nexpay. While Globitex exchange was our main product, this made perfect sense, however quickly after launching the EURO Wallet, it became our main business and currently represents around 80% of the Globitex group business. It has been quite challenging operating the payments business without a strong brand in terms of marketing, PR, client relationships as well as some legal aspects, which is why we have decided to give the Nexpay brand the visibility it deserves. From here on out the Globitex platform will be the Nexpay platform.

In the immediate future, our services will not be changed or affected except for some slight improvements to the user interface. The Globitex exchange will be accessible through the Nexpay platform and will continue providing its services without interruption. The GBX token will continue providing exclusive discounts and benefits to the users who hold them. We are confident that this upgrade will help take our business to the next level.

Plans Ahead

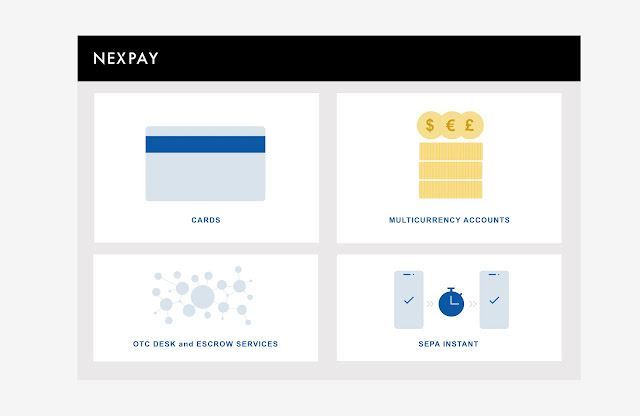

The first milestone in 2021 is to make our product more retail-friendly and the one thing that has been missing for that is a cards program. We are aiming to bring a payment card for retail clients of Nexpay in Q2. This will significantly improve our value proposition for private individuals and will serve as a foundation for further development of our retail business. Globitex exchange users will have the opportunity to enjoy extra benefits by staking their GBX tokens to get discounted fees and up to 8% cashback on their card purchases.

Further developments are planned on the Nexpay payments product offering, including opening multi-currency accounts with international payments as well as connecting to SEPA Instant which has recently seen rapid adoption among EU financial institutions with more than 50% already connected according to European Payments Council. There will also be significant improvements to the platform interface, making it more convenient for our business clients, as well as a more convenient channel for our business clients to transact directly on our platform.

Development priorities for Globitex exchange business are our OTC and Escrow products offering. We have already started piloting these services, however lots of work is still required to make them into effective and convenient solutions for our clients. On the exchange orderbook, we are constantly improving liquidity depth and this will remain a key focus. We will continue evaluating adding new kinds of digital assets on the exchange as we see the demand from our clients. In terms of further developing the exchange into a regulated derivatives and commodities exchange we will continue to evaluate market conditions for when is the right time to launch such products as explained in the paragraphs above.

Our short term aim is to become the go-to financial infrastructure provider for digital assets businesses in Europe and with the explosive growth we enjoyed in 2020, we are very well positioned to achieve that goal in 2021.